There’s a version of the founder story you don’t hear often.

One that doesn’t involve an all-nighter. Not even a Slack fire-drill, or a feeling in the pit of their stomach when a user churns at 6:14 A.M.

But one of clarity instead, where deliberate choices stack day by day and CAC doesn’t swing wildly by the week, till product market fit is attained.

Where revenue is still modest because retention makes the model work. And where meetings with investors don’t feel like performance theatre anymore. They’re just updates from a place of confidence.

Here, the dashboard doesn’t need to shout at all. The numbers speak clearly instead:

Fewer trials. More traction. Fewer bets. More signals.

You only see this when you’re on the other side of the startup lunch noise, and only if you’re able to find the best soft launch strategy for your business.

Unfortunately, most founders never get there. Blame that on the sprint-launch-fix cycle every Startup Accelerator expert teaches though. They put founders on a loop where they. Ship early. Get attention. Patch later. Then wonder why confidence never compounds.

And it’s not hard to know when founders are caught up in this.

One moment, they’re high-fiving over Product Hunt upvotes. Next, they’re wondering why no one logs in anymore. So they tweak the pricing page. Run another ad and burn a little more runway looking for answers.

I’ll bet $1000 you’ll rather remain in a small group that builds differently and launches confidently.

Not starting out with a bang, but with sense-making through the Gold Standard approach to launching.

But wait… did I guess right?

If not, and you’re still planning to launch without traction, or you still confuse attention for validation, ask yourself… are you trying to be seen, or trying to get somewhere?

You really shouldn’t walk right past the one thing that makes everything else easier.

Why Blind Blitzes Burn the Runway Before Day One

On the third day of the Battle of Gettysburg (July 3, 1863). Gen. Robert E. Lee ordered Lt. Gen. James Longstreet to strike the center of the Union line on Cemetery Ridge.

So some 12 000 Confederate troops under George Pickett, Pettigrew, and Trimble stepped from the tree line and marched three-quarters of a mile toward Cemetery Ridge.

Shoulder to shoulder they marched with flags high and no cover. Union troops on the other hand, waited on the ridge and both flanks, guns in hand and barrels already sighted.

The bombardment that was meant to soften the defenders had overshot, so when the gray ranks entered the open ground, Federal artillery opened in full force.

Gaps tore through the lines, the formations closed, and the mile-long advance kept moving.

But when the survivors reached the stone wall, Union musket fire met them at point-blank range. A single brigade breached the wall for a heartbeat; then the blue line surged and drove them back.

Less than an hour after the first step, the assault dissolved. Half the attackers lay killed, wounded, or captured; the rest drifted toward the rear in silence.

The field they had crossed smoldered under summer haze—the moment forever marked as the high-water point of the Confederate cause and proof that raw momentum shatters against prepared math.

That’s what a launch drama looks like when demand is guessed and not proven.

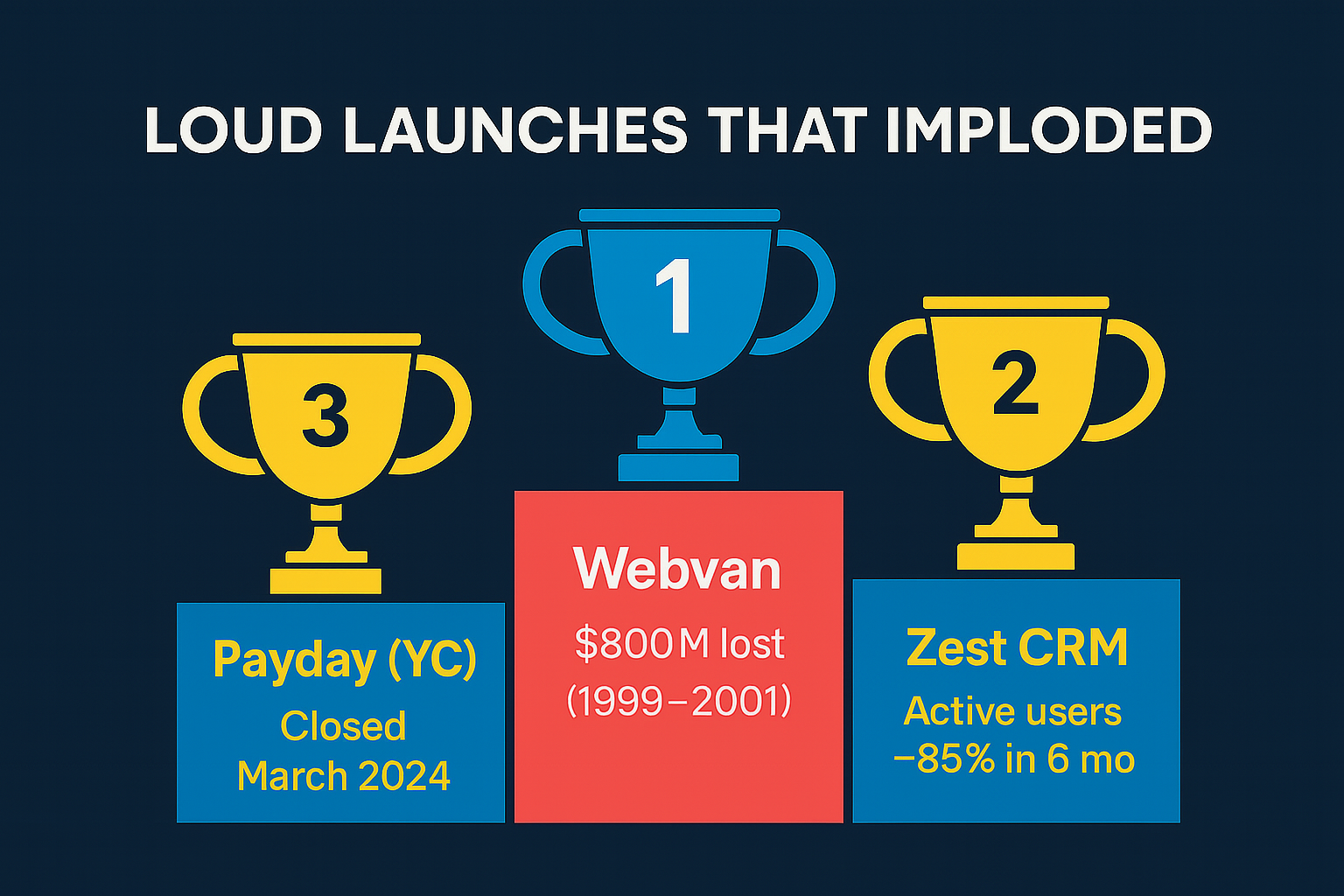

Back in 1999, Webvan was touted as the future of groceries. Or so everyone thought… The company raised a whopping $800 million, built warehouses, bought trucks, and spent fortunes on PR so people couldn’t turn on the TV without hearing about them.

The problem?

Webvan hadn’t actually asked if anyone needed groceries delivered the Webvan way. They assumed demand, skipped real customer validation, and sprinted straight to market saturation.

What followed was unfortunately inevitable… an $800 million implosion. Trucks got auctioned faster than they were bought, warehouses shuttered, and investors burned.

Fast forward to 2024 and you’ll still see founders reenact the scenes.

These founders stride into the market with fresh capital, bright banners, zero proof—and watch the runway vanish under an artillery they never scouted.

For example, Payday, with YC backing, raised $3 million and was still gone by March 2024.

Zest, the sleek CRM, similarly had a loud release. Unfortunately, users tried it but didn’t stay. So burn climbed, faith fell, and investors left. Same scenes again (unfortunately).

You’ve probably seen it yourself too…

The flashy Product Hunt debut. Paid ads flooding social feeds. PR blitzes pitching startups as the next big disruptor.

But do you know what happens beneath the noise?

Customers sign up, take a look around, then quietly leave. Retention stalls. Engagement flatlines. Acquisition costs spiral out of control.

Why? (Good you asked.)

It’s because launching loud is a gamble. It’s betting the house on assumptions instead of facts. A sordid proof that vision isn’t merely always the gap. Validation mostly is.

Truth is, most SaaS products hit the market half-baked, being built on guesses, untested hypotheses, and gut feelings masquerading as strategy.

Webvan ignored validation and burned through $800 million in no time. For early-stage SaaS, the currency might be different, but the result’s the same: Runway vaporized, dreams crashed, lessons learned the hardest way possible.

But smart founders don’t guess—they know. And knowing requires something radically different from what everyone else is doing.

Because big coverage can’t patch weak retention. And Cost of Acquisition spikes aren’t marketing mysteries but your unit-economics screaming for a tighter funnel and a saner payback window.

Every corpse on the startup field thought speed would outrun uncertainty, where survivors learned and approached things differently.

If your go-to-market looks like a blind charge across open ground, don’t act surprised when the smoke clears and you’re the one left lying there.

So hold the budget and silence the megaphone for a moment.

Instead, run the reality checks below and run on principles that anchor every successful release and expose weak spots long before the market does.

Reality Check #1: Product Launch ≠ Marketing Launch

Marketing launch day usually feels like a win until the retention tab loads.

That’s because when it’s run, views spike in a flash, trials flood in, and dashboards turn green… until the truth appears in red.

This is very unlike what product launch, which is hinged on “product love” is all about.

So what does “product love” look like when the numbers finally settle?

Simple. Product love shows up in three lines of math:

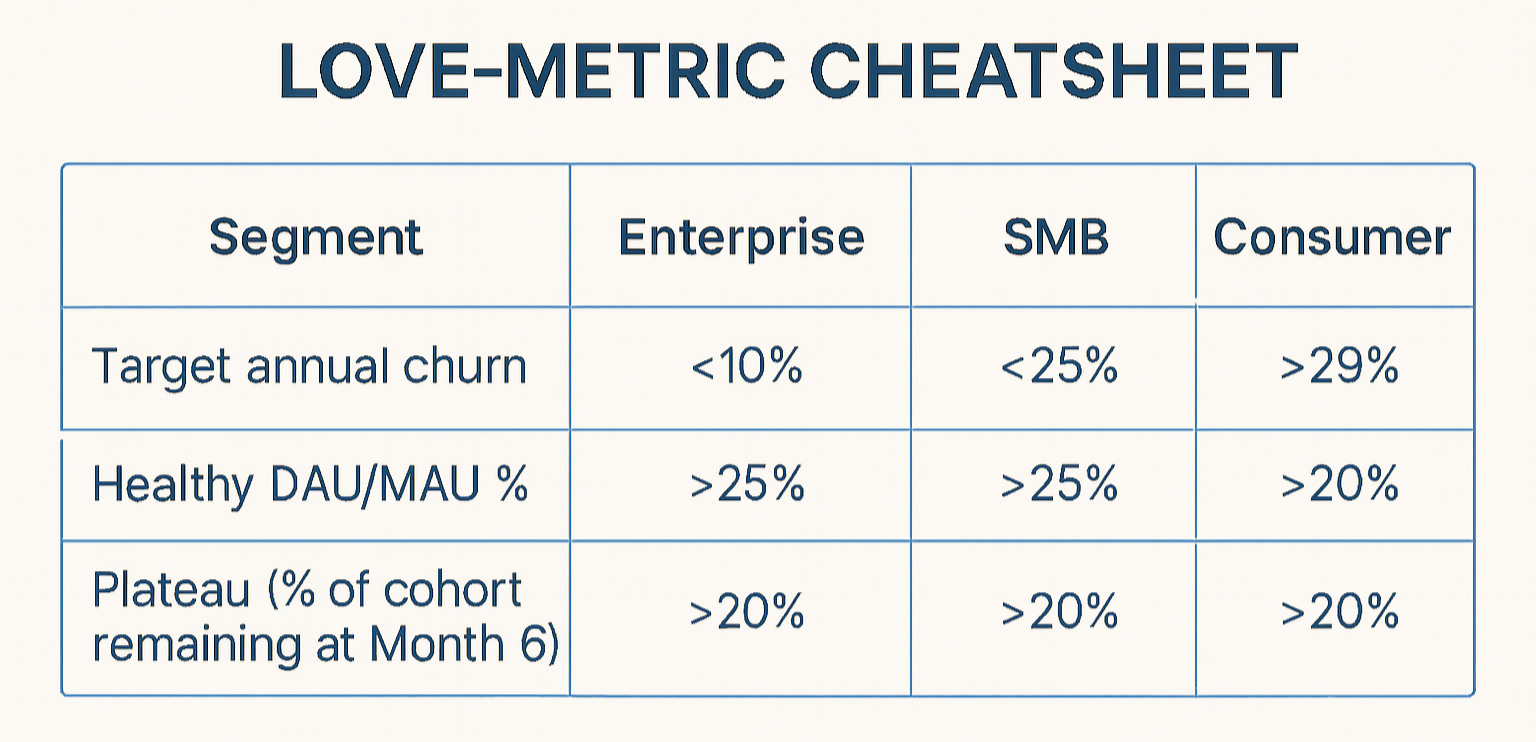

- Churn. Enterprise SaaS survives when annual loss stays under ten percent. SMB or consumer apps can tolerate the high twenties, but cross thirty and repeatability fades.

- Engagement. A healthy product sees at least a quarter of monthly actives logging in every day. Fewer visits mean users remember the tool only when they plan to cancel.

- The tail. A retention curve should drop, then level. Twenty percent months out signals lasting value. A line drifting toward zero predicts vanishing cash.

Hold those three signals—low churn, solid DAU/MAU, and a stable plateau—and your funnel will be able to handle volume. Miss one and every paid click leaks like water through a cracked bucket.

The legendary Sean Ellis, early growth architect at Dropbox and Eventbrite and now founder of GrowthHackers, author of Hacking Growth, and host of the Breakout Growth Podcast walked right into that leak with a client.

Registrations looked great. Activation didn’t exist. And more than ninety percent of fresh sign-ups never touched a feature. Company-threatening, he told the CEO. Instead of buying more traffic he asked for four months to fix the funnel.

His team mapped every hesitation in onboarding and found the biggest friction to be that users doubted their “free” promise, claiming that it sounded too good. So they tested with a fix that felt almost trivial…

Show a clear choice. So they highlighted Free with a bold check-mark beside Paid. That single toggle tripled downloads of the free plan overnight, and the credibility spill-over boosted paid conversions, too.

Dozens of micro-tests followed. Copy tweaks, progress indicators, subtle nudges around first value moments. Four months later the signup-to-usage rate jumped tenfold. Same marketing budget, ten times the active users. CAC per engaged customer collapsed without burning an extra cent.

That is what learning looks like… small experiments shifting unit economics instead of vanity dashboards.

Compare that discipline with the average seed-stage spend pattern.

Founders bank on press hits, pump CPM campaigns, cheer hockey-stick sign-ups. Untargeted ads compound churn, with one-percent lead-to-customer conversions driving ninety-nine cents of every dollar into bounce traffic.

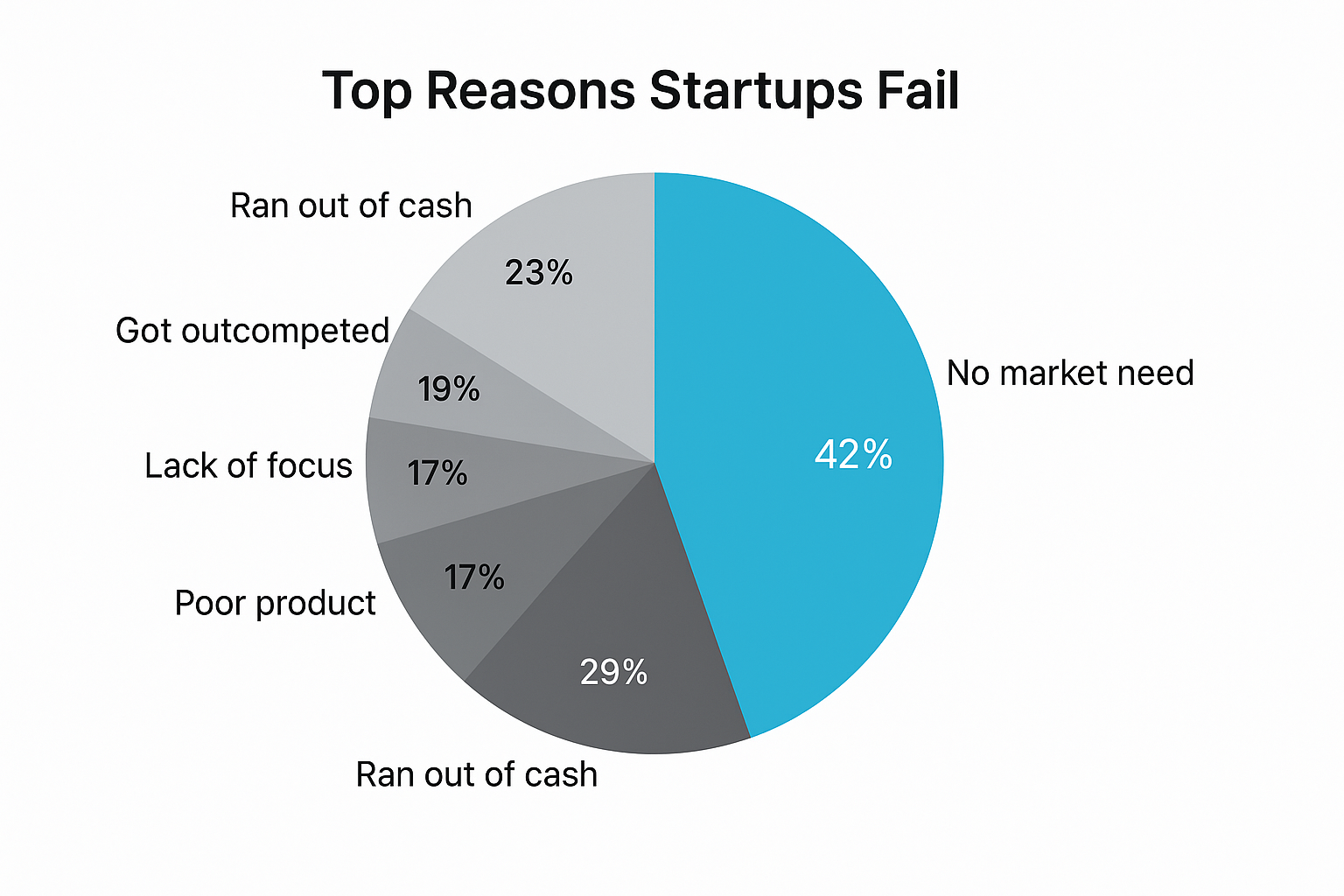

What makes this critical? The fact that CB Insights lists “no market need” as the chief startup killer. Even post-mortems repeat the chorus “We scaled before we proved anyone cared.”

So think of growth as a bucket. Product love plugs the holes; marketing fills the water.

Pour first and you risk funding evaporation. But wait until the bucket holds at least Day-1 and Day-30 retention above your category average, and then every drop counts.

Now this means you need to run this gut-check before your next spend:

- Who buys, and why now?

- Which single pain feels mission-critical enough to trigger payment today?

- How many users hit their “aha” moment inside the first session?

- Do week-one activation, month-one retention, and referral rates signal product worship or polite curiosity?

If the answers lean on optimism rather than data, keep the budget closed.

Lifetime value must dwarf acquisition cost because when inflated CAC stretches payback, pressure mounts, and leadership always end up trying their hands at louder campaigns to hide the leak.

The end result is that the loop tightens with more spend, margins shrink, investors doubt and silence follows the noise.

But sequence always breaks the spiral.

So validate with small numbers first. Look for daily engagement above twenty-five percent, churn below the right benchmark, and click paths that mirror the story you tell in demos.

When those lines hum together, your marketing will shift easily from cost to leverage.

Based on Sean’s experience as sighted above, his team decided to keep a new rule that can be summed as… any experiment that fails to lift activation by two percentage points in a week retires on Friday.

The reality is that momentum lives in the spreadsheet, not the press kit.

When retention whispers readiness, the megaphone comes out; until then, the wallet stays shut and the product crew keeps shipping.

Skip that rhythm and the market writes the bill which is never-ending, expensive, and final.

Ready to run a quiet loop? Book a Validation Strategy Call

Reality Check #2: Attention Won’t Save You

Founders rarely set out to waste their runway…

But because of what the experts and accelerator mentors say, they mostly follow advice that looks safe on the surface.

Unfortunately, this advice results in certain hard launch moves that are a blatant waste of time as they feel like progress until the numbers push back when the metrics arrive.

Move One: Lighting The PR Fuse.

Here’s how the publicity rush plays out.

You: “TechCrunch locked for Tuesday. Product Hunt slot confirmed. We’re ready to blow this up.”

Me: “Classic first move. Quick question—what’s the plan after the spike?”

You: “We ride the buzz, right? Early sign-ups, social proof, investors notice.”

Ah, that’s the script everyone quotes.

Startup Genome dug into 3,200 post-mortems and found that launches built on noise before proof show up in seventy percent of flameouts.

The sad thing is it results in the same opening scene every time.

Tuesday — phone buzzes, Slack erupts, dashboards shoot north.

Wednesday — numbers hover.

Thursday — growth line eases.

Friday — traffic slides like a playground chute.

Founders end up being like “We expected a dip, just didn’t think it’d be this sharp.”

But in reality, that dip is the backwards playbook in action where teams do PR first, validation later.

You just put a spotlight on a funnel that isn’t airtight, so the world watched the leak in real time.

And when attention hits an unproven product, it doesn’t create traction—it measures readiness.

So if retention math isn’t solid, the only thing PR guarantees is a public stress-test you didn’t study for.

Move Two: Cranking The Ad Engine.

When the ad budget steps on the gas, the campaign launches on broad keywords and cold audiences to the tune of two, maybe three grand a day.

On day-one, the CAC usually lands neatly in the green cell of the spreadsheet. Then everyone nods as the budget doubles at tomorrow’s stand-up.

Ten days later the cohort report refreshes.

Most of those newcomers never reach first value while some do. Soon, refund emails start to drip in. And by the time silent churn finishes its lap, blended CAC is three to five times higher than the opening read.

This usually ends in finance revising the runway from quarters to weeks.

Move Three: Staffing Up For Growth.

This is where headcount balloons before retention stabilizes.

A content marketer joins, then a demand-gen manager, then a junior designer.

The team gets busy immediately.

Calendars soon fill with campaign stand-ups. Lead counts also inch up, but conversion stays sideways because users still fail to reach first value.

This results in payroll growing faster than revenue, and suddenly a Series A round that once felt optional turns mandatory.

Move Four: Treating Launch Week Like The Super Bowl.

Here, the launch day starts to feel like an awards show as swags stacked at the door, branded hashtags get pinned to every slide, livestream countdown starts pulsing in the corner of the screen.

The product drops, Twitter erupts, fire-emoji threads race through Slack, traffic surges.

Everything aims at one shot of momentum.

Then by Monday the chat room echoes like a convention hall after teardown. No onboarding loop, no nurture sequence, no habit engine—nothing underneath the spike—so the applause evaporates faster than the confetti that introduced it.

And that’s where the launch goes to die.

All four moves grow from the single belief that enough spotlight fixes uncertainty when in reality, the spotlight exposes cracks.

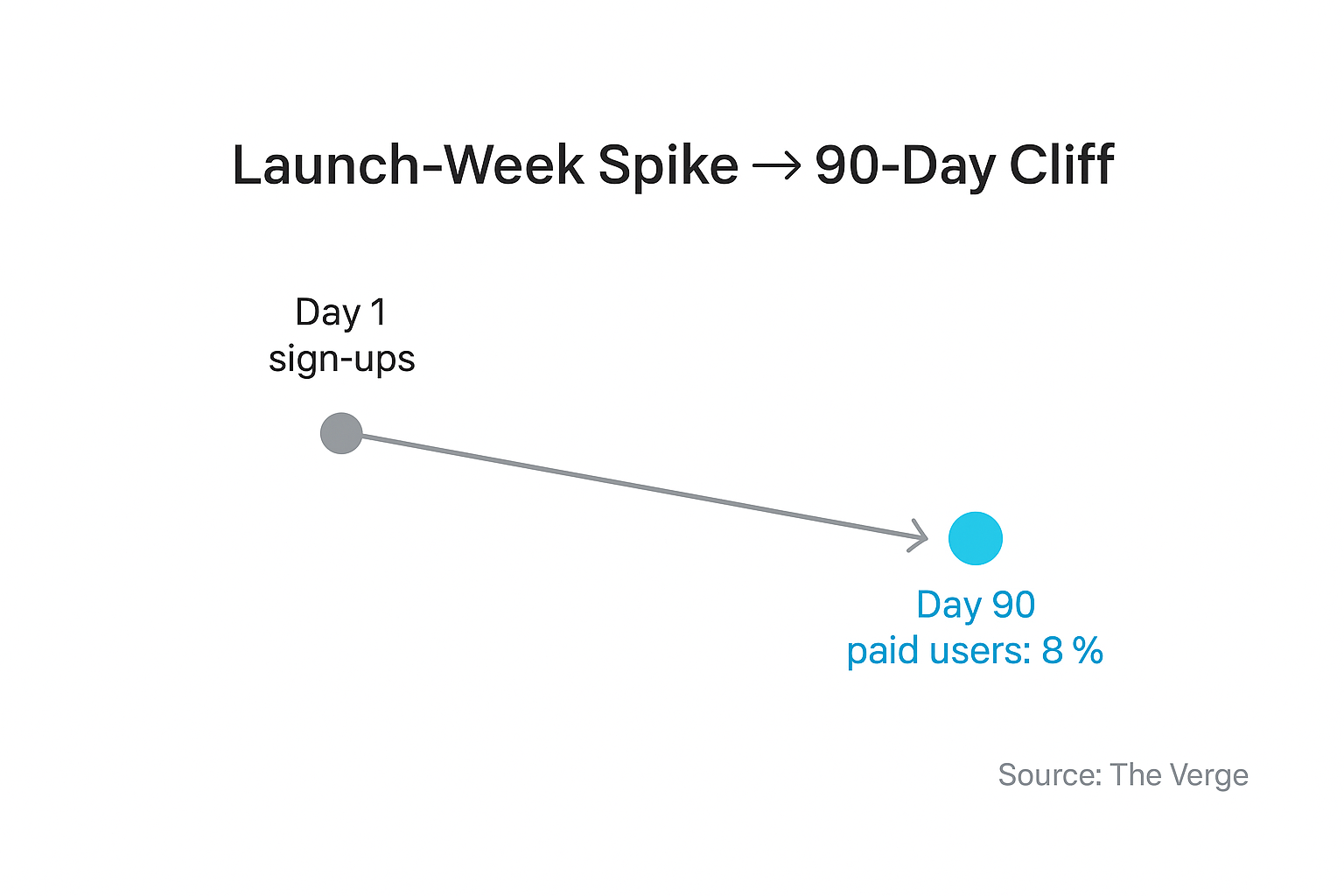

Take Quibi, a short-form streaming service of professionally produced shows for instance.

The company secured roughly $1.75 billion in funding ahead of its April 2020 debut; the app opening at No. 3 on Apple’s U.S. App Store after tallying about 300 000 launch-day downloads.

But some Sensor Tower’s cohort data later, and it was clear that out of roughly 910,000 early sign-ups, only about 8 percent stayed once the three-month free trial expired. That signaled a 92 percent drop-off that no amount of launch hype could offset because no retention math backed the hype.

So scale the numbers of any launch down to seed level and here’s what you’ll find:

Founders who pour more than forty percent of capital into acquisition before thirty-day retention clears industry averages double their odds of closing shop within eighteen months.

But teams that dodge that fate work in low volume first because ten real customer conversations out-learn ten press clippings.

Even a twenty-dollar smoke-test landing page outperforms a full funnel no one sticks around to finish.

These teams wait until the daily-active-to-monthly-active clears twenty-five percent and churn drops below their model ceiling before they hire marketers.

They treat a launch as the midpoint of a feedback loop, not a finish line.

So before your next launch/re-launch spend cycle, pause and ask yourself these three questions.

- How much of last month’s cash bought learning instead of eyeballs?

- How many newcomers reached the core feature twice during week one without a nudge?

- Can you name a single experiment that moved activation two points or more?

Vague answers to these mean the funnel has a leak.

Pouring traffic through that leak will only turn a mild drip into a flood where CAC erupts higher the mountain, morale sags, board calls get tense, and budgets suddenly freeze out.

Silence always follows the noise because attention compounds churn faster than it compounds value.

But this playbook will flip the moment you accept that demand requires proof. While quiet groundwork may look dull in a moment, it widens out as strategic options begin to pile up.

Skip the sequence and every move above will still feel like momentum, right up to the day the bank account explains otherwise.

Reality Check #3: Under-Resourced Teams Win By Seeking Volume Only After Verification

While launch spikes feel good, thin teams don’t live on dopamine. They live on math. And the founders who don’t sleep through metric reviews work a simpler order themselves:

Proof first, volume second.

Now here’s how that rhythm unfolds when the company wallet is light and every hour counts.

First comes the pulse.

Drop twelve tight DMs to people who have already groaned about the problem you claim to solve.

Half will ignore you. Seven will answer. Three will jump on a quick call and tell the same story in different words. That tiny data set is enough to decide whether the next sprint goes forward or gets shelved. No Typeform, no paid panel—just honest voices, fast.

Patterns in hand, spin up a five-minute demo. A Figma click-through, a Loom walk-through, a single-page PDF—whatever shows the promise without burning engineering cycles. Send it back to the same cohort and watch the forty-eight-hour heartbeat: opens, forwards, calendar invites. Crickets mean tweak and resend; reactions mean step three.

Charge early, charge something.

Optimize for a $200 pilot invoice, a dated letter of intent, a credit-card hold—small money that forces a prospect to choose between “nice idea” and “need it now.”

Payment this early does two things at once… it proves urgency and sketches the first line of your payback curve. If wallets stay closed, be grateful; you’ve saved months of runway.

Now stare at thirty-day retention like it’s the only graph that matters, because it is.

Users who bail inside a month signal a leak you can patch while the cohort is tiny. Users who plateau north of a 25 percent DAU/MAU ratio give you an anchor metric investors respect. Only when the curve flattens and churn sits below the segment ceiling does the paid-traffic faucet start to twist open.

Sounds neat, but who has time? You say.

But look at it this way. Aren’t you already planning to reach prospects, ship rough assets, and chase invoices?

The loop just compresses those motions into one deliberate circuit so effort compounds instead of scattering.

And if no one replies… that’s clarity bought cheaply. Better to hear crickets now than watch five-figure ad runs expose the same apathy after the burn.

What is even better is that while free feedback tells you what people think, paid pilots tell you what they’ll sacrifice to fix the pain. The second insight is priceless where the first is optional.

Ask any partner what thrills them more today. Raw sign-up volume or a small cohort that sticks and pays back inside months. (Sure you know the answer already.)

Oftentimes, the loop works on its own, but founders deep in code and the burden of shipping often stall between steps, especially when customer support starts adding on top of that.

Sometimes the loop might just feel tight and you’d rather run it with seasoned guides.

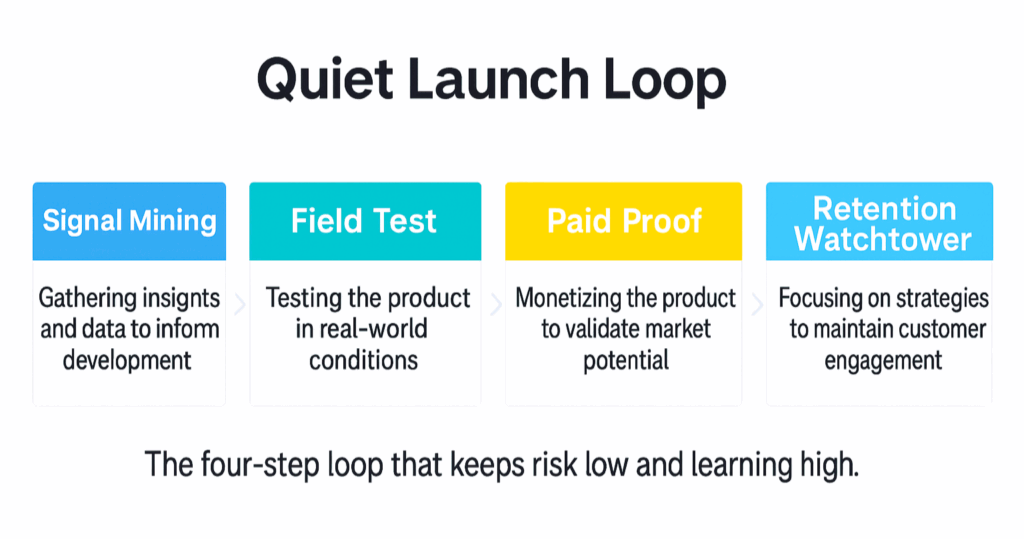

Either way, the Validation Accelerator was built for you. Over six weeks we orchestrate four power-packed milestones that guide you to a smart launch, so by week seven you hold a data-backed go-or-grow decision that signals the green light or a graceful stop.

- Signal Mining. Twelve moderated calls booked and done for you. Each transcript feeds an Ideal Customer Insight Deck that sharpens every headline and roadmap ticket.

- Field Test. In week two we hand you a full blueprint for a five-minute demo that includes copy, flowchart, and tracking checklist. Your team plugs it in, ships fast, and starts collecting forty-eight-hour usage data that tells you more than any survey ever could.

- Paid Proof. We script the pilot offer, draft the invoice, and coach the close. Money in the bank by week four or we rework the pitch until it lands.

- Retention Watchtower. Activation, day-seven stickiness, day-thirty usage—instrumented and reviewed before a single paid ad leaves the wallet.

Founders who finish the sprint will walk into investor updates with churn under target, activation on record, and CAC-to-LTV math no one has to squint at. Marketing hires arrive later, cheaper, and focused on levers that already move revenue.

Miss any milestone and we work an extra sprint free. (Proof or no paywall. That’s how certain we are.)

Ready to trade noise for certainty?

Lastly…

Volume becomes leverage only after verification.

Secure the proof and the growth will follow.